Tax and

Compliance

Staying compliant, responding to ATO notices, or keeping up with regulatory changes shouldn’t be part of your daily list. We manage your full compliance cycle accurately, consistently, and always on time.

Our Tax & Compliance Services ensure your business meets every requirement across federal, state, and corporate tax obligations.

What We Offer

Ongoing Tax Compliance

- PAYG Withholding & Instalment tracking

- GST calculations and submissions

- FBT lodgement and fringe benefits recordkeeping

- GST Audit and Reconciliation

- Business valuation

- Audit preparedness

Annual & Specialist Returns

- Income tax returns for companies, trusts, and partnerships

- Fringe Benefits Tax (FBT) year-end reconciliations

- Corporate structuring advice keep only tax planning

- Trust distributions and partnership reporting

Tax Strategy & Forecasting

- Tax position reviews and planning for year-end

- Forecasting PAYG instalments and cash impact

- Audit preparedness and ATO correspondence management

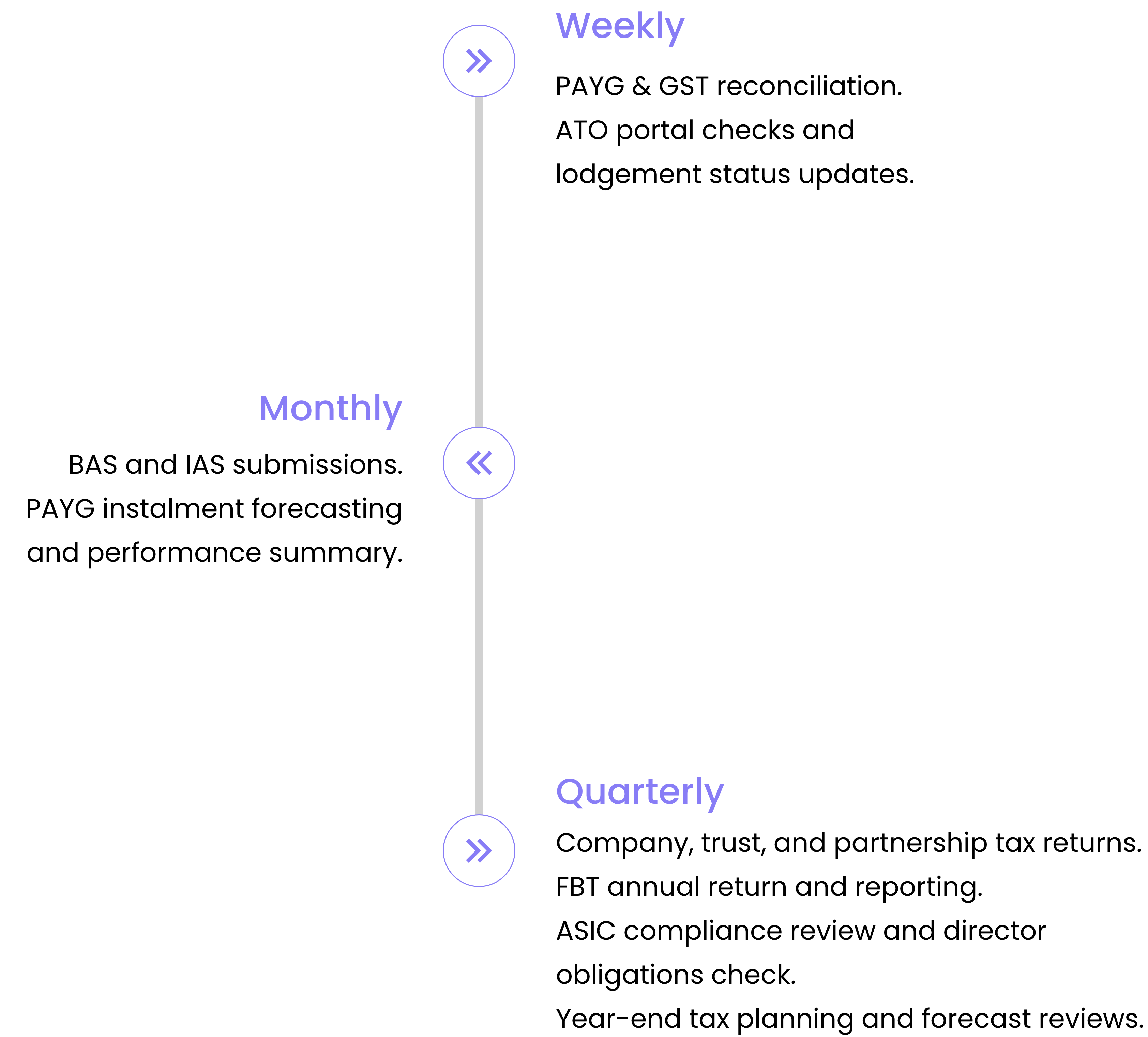

How We Work

Quarterly

BAS and IAS submissions.

PAYG instalment forecasting and performance summary.

Monthly

PAYG & GST reconciliation.

ATO portal checks and

lodgement status updates.

Year-End

Company, trust, and partnership tax returns.

FBT annual return and reporting.

ASIC compliance review and director obligations check.

Year-end tax planning and forecast reviews.