Finance and

Accounting

As your enterprise grows, so does the complexity of your financial operations. From managing payables and receivables to ensuring timely month-end closes and audit-ready records, our bookkeeping services are designed to take the load off your internal teams—while maintaining full compliance, accuracy, and control.

What We Offer

Accounts Payable & Receivable Management

- Automated invoice capture and 3-way PO matching

- Custom approval workflows and batch payment processing

- Invoicing, receipt matching, and credit control follow-ups

General Ledger & Month-End Close

- Journal entries, accruals, intercompany adjustments

- GL maintenance, reconciliation schedules, and closing checklists

- Month-end support aligned to your internal deadlines

Fixed Asset & Multi-Entity Accounting

- Asset register maintenance and depreciation schedules

- Elimination entries, group-level P&L and Balance Sheet reporting

- FX handling and intercompany consolidation

Reporting & Compliance

- Preparation of BAS, IAS, and annual financial statements

- KPI dashboards, management reports, and audit-ready books

- Statutory data collation for AASB/IFRS compliance

FINANCE and ACCOUNTING

As your enterprise evolves, so do the demands on your finance and accounting function. From managing end-to-end payables and receivables to streamlining month-end closures and ensuring audit-ready financials, our Finance & Accounting services are built to support your internal teams with precision, compliance, and control. We bring structure, scalability, and strategic alignment to every process—so you can focus on driving growth while we take care of the numbers.

What We Offer

Accounts Payable & Receivable Management

- Automated invoice capture and 3-way PO matching

- Custom approval workflows and batch payment processing

- Invoicing, receipt matching, and credit control follow-ups

General Ledger & Month-End Close

- Journal entries, accruals, intercompany adjustments

- GL maintenance, reconciliation schedules, and closing checklists

- Month-end support aligned to your internal deadlines

Fixed Asset & Multi-Entity Accounting

- Asset register maintenance and depreciation schedules

- Elimination entries, group-level P&L and Balance Sheet reporting

- FX handling and intercompany consolidation

Taxation & BAS Lodgement Support

- GST calculation and reconciliation

- BAS/IAS preparation and digital lodgement

- Documentation support for audits and tax agents

Reporting & Compliance

- BAS, IAS, and Annual Financial Statement Preparation

- KPI Dashboards & Management Reports

- AASB/IFRS-Compliant Data Collation & Audit Support

- STP Reporting and Year-End Finalisation

- TAPAR Submissions (Taxable Payments Annual Report)

- ASIC & ATO Compliance Workflows

- Work Hour Compliance Tracking

What We Offer

Accounts Payable &

Receivable Management

Automated invoice capture and 3-way PO matching

Custom approval workflows and batch payment processing

Invoicing, receipt matching, and credit control follow-ups

General Ledger &

Month-End Close

Journal entries, accruals, intercompany adjustments

GL maintenance, reconciliation schedules, and closing checklists

Month-end support aligned to your internal deadlines

Fixed Asset & Multi-Entity Accounting

Asset register maintenance and depreciation schedules

Elimination entries, group-level P&L and Balance Sheet

Reporting FX handling and intercompany consolidation

Reporting & Compliance

Preparation of BAS, IAS, and annual financial statements

KPI dashboards, management reports, and audit-ready books

Statutory data collation for AASB/IFRS compliance

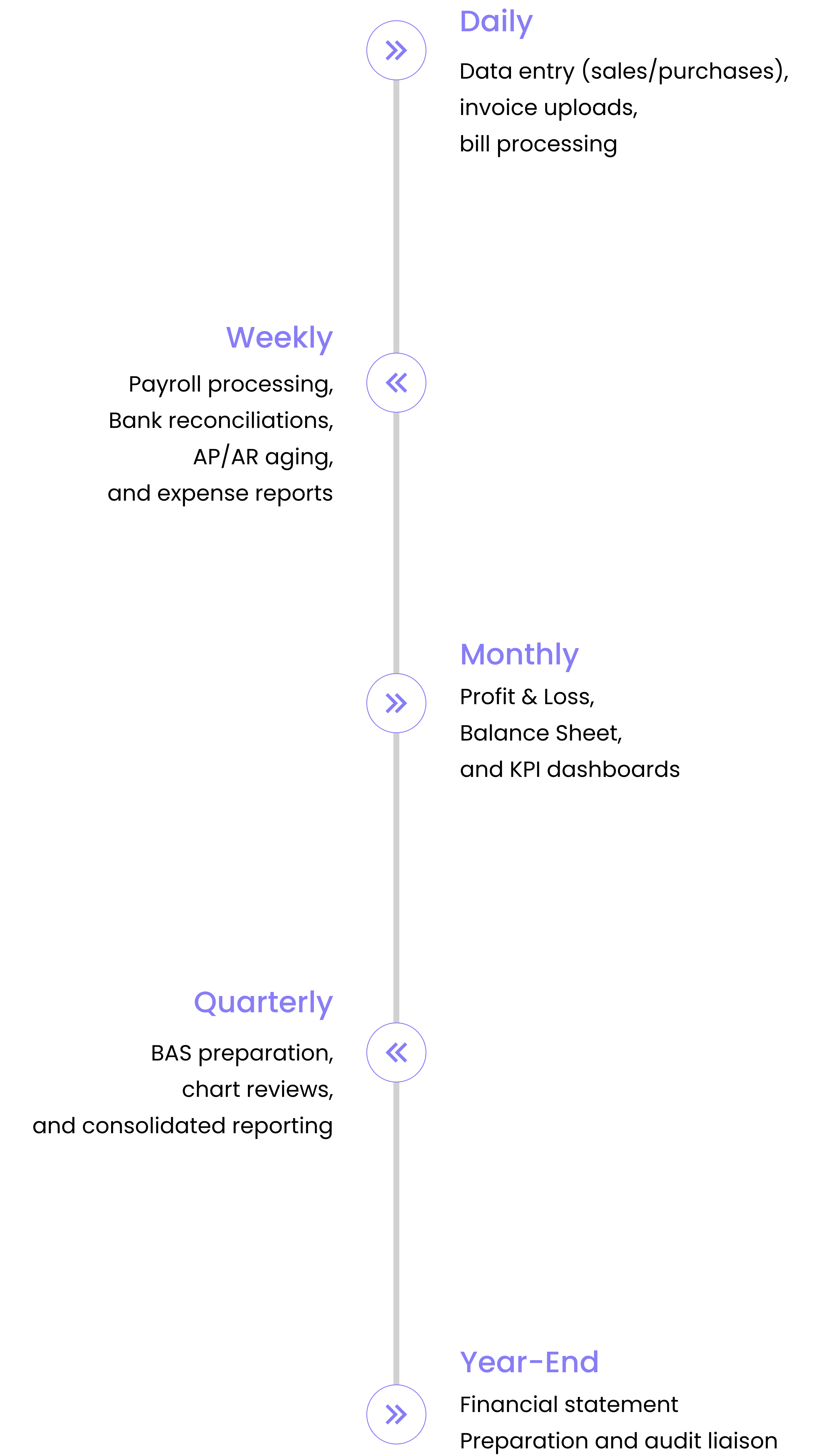

How We Work

Daily

Data entry (sales/purchases),

invoice uploads, bill processing

Monthly

Profit & Loss, Balance Sheet,

and KPI dashboards

Year-End

Financial statement

preparation and audit liaison

Weekly

Bank reconciliations, AP/AR aging,

and expense reports

Quarterly

BAS preparation, chart reviews,

and consolidated reporting

PAYROLL MANAGEMENT

Managing payroll in a growing business isn’t just about getting people paid—it’s about maintaining compliance, building employee trust, and meeting the increasing complexity of regulatory requirements. we take full ownership of your payroll operations, ensuring every cycle is accurate, compliant, and on time—no matter how complex your workforce setup.

From interpreting modern awards to handling STP Phase 2, superannuation, payroll tax, and EOFY submissions, we provide a fully managed payroll solution that keeps your business aligned with Fair Work and ATO standards.

What We Offer

End-to-End Payroll Execution

- Weekly, fortnightly, or monthly payroll processing

- Data collation from timesheets, overtime, leave, bonuses & EAs

- Seamless handling of termination, redundancy, and back-pay

Compliance & Regulatory Support

- Modern award/EBA interpretation and automation support

- STP Phase 2 reporting and finalisation

- Payroll tax (multi-state), PAYG, superannuation lodgement

- Year-end income statement generation & EOFY finalisation

Workforce Entitlement Management

- Accurate tracking of leave accruals, RDOs, TOIL

- Real-time updates to payroll master data

- Reconciliation of bank, PAYG, and super transactions

Employee Helpdesk Support (Optional)

- Direct query resolution for payroll-related employee issues

- Quick response to payslip, leave balance, and tax questions

How We Work

Daily

Timesheet collection, leave tracking, master data updates

Monthly

Superannuation lodgement, payroll variance reports, payroll tax submissions

Year-End

Final STP submissions, EOFY reconciliations, workers’ compensation support

Weekly

Payroll processing, STP reporting, payslip delivery

Quarterly

Award rate reviews, lodgements, FBT prep

A software development company specializes in the creation and upkeep of software applications. They collaborate with clients to analyse their requirements and develop tailored solutions. Additionally, a software development company offers continuous support and maintenance for the software they produce.

For the definite accounting for the software development companies, we perform invoicing for checking the AR & AP, Budgeting, and regular reconciliation of transactions. Expertise in Customer Acquisition Cost (CAC Report), Customer Lifetime Value report (CLTV Report), Deferred Revenue spreadsheet, Annual Recurring revenue (ARR Report).

Fitness centres offer members a variety of amenities including exercise classes, state-of-the-art equipment, qualified instructors, spa services, and Personalised fitness training. By providing a consistent and distinctive fitness experience in a welcoming environment, businesses can cultivate a devoted clientele.

The goals, objectives, and activities of a gym business can vary depending on the specific business, but here are some common examples: Goals: To increase the number of members and revenue. We will be taking care of the timely payments, invoicing, recording of transactions and other month-end tasks.

As stewards of cleanliness, it is imperative to recognize the significance of meticulous attention to detail. A single error could potentially jeopardize all financial endeavours.

Record management issues : Absence of Organised storage poses a threat of misplacing vital documents such as receipts and invoices, hindering proper cash flow monitoring. Inaccurate revenue tracking: Diligence is required to ensure accurate recording of all payments. Overlooking any revenue source might lead to erroneous financial statements, compromising the accuracy of tax filings.

Challenges with expense classification : It is crucial to meticulously categorize various expenditures based on their respective purposes and significance. Failure to do so could result in incomplete financial documentation, affecting the precision of economic reports.

The realm of restaurant accounting involves the comprehensive management of all financial operations within a restaurant or restaurant conglomerate. This includes the precise documentation of acquisitions and continual expenditures, as well as the generation of financial statements that enable proprietors to promptly make informed decisions based on current data. This insight into the overall functioning of a restaurant facilitates the ability to evaluate and decipher crucial facets of the enterprise, such as expenses, income sources, and financial liquidity.

Operational Gaps

We Help You Eliminate

At Purple Quay, we don’t just deliver services we solve persistent financial and compliance issues that slow your business down. Here’s what we help you eliminate with our Accounting, Bookkeeping, and Payroll expertise:

Late BAS and IAS lodgements exposing your business to ATO penalties

Inconsistent bookkeeping across entities leading to reporting discrepancies

Delayed month-end closes that stall financial insight and business decisions

Payroll errors undermining employee trust and Fair Work compliance

How We Work

Daily

Data entry (sales/purchases),

invoice uploads, bill processing

Monthly

Profit & Loss, Balance Sheet,

and KPI dashboards

Year-End

Financial statement

preparation and audit liaison

Weekly

Bank reconciliations, AP/AR aging,

and expense reports

Quarterly

BAS preparation, chart reviews,

and consolidated reporting